“That’s Kanye West, he about to be the next one” – Jamie Foxx

This post is a little different from what I normally write about (educational technology). I wrote this in the middle of 2020 but only recently I dug this out, edited and published this. Please enjoy!

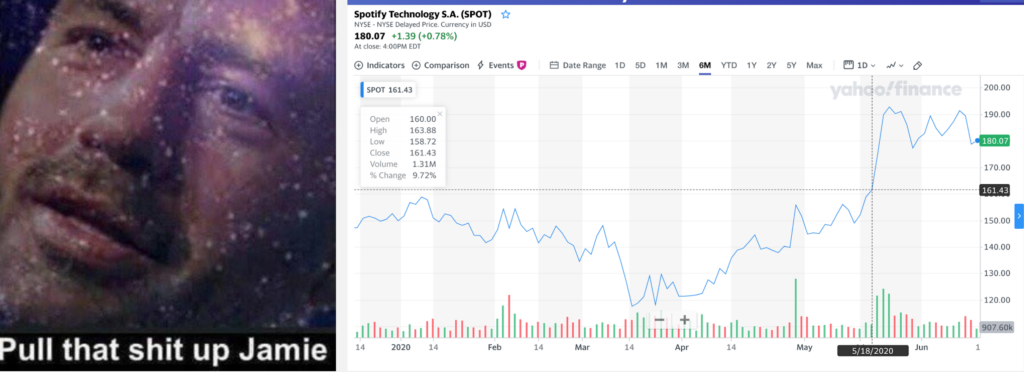

The Joe Rogan Experience is coming to Spotify in 2020. Spotify announced on May 19th, that it had signed a multi-year licensing deal to move the Joe Rogan Experience to be exclusive on Spotify from September 2020.

Whilst details weren’t disclosed, estimates of the size of the deal range from $200-300 million. Following the announcement, Spotify stock zoomed and managed to add $3B in extra market cap, in essence making the deal free for Spotify.

This article explores the ways in which podcasting represents an immense opportunity for Spotify. It is the only company that is systematically executing on a strategy in the podcasting space.

Why Podcasts?

The first word that comes to mind when anyone says Spotify is – music.

Indeed, it is now the largest music streaming app and has largely nullified the problem of music piracy. Music streaming has helped turn around the music industry’s fortunes which looked terminal prior to the advent of streaming services.

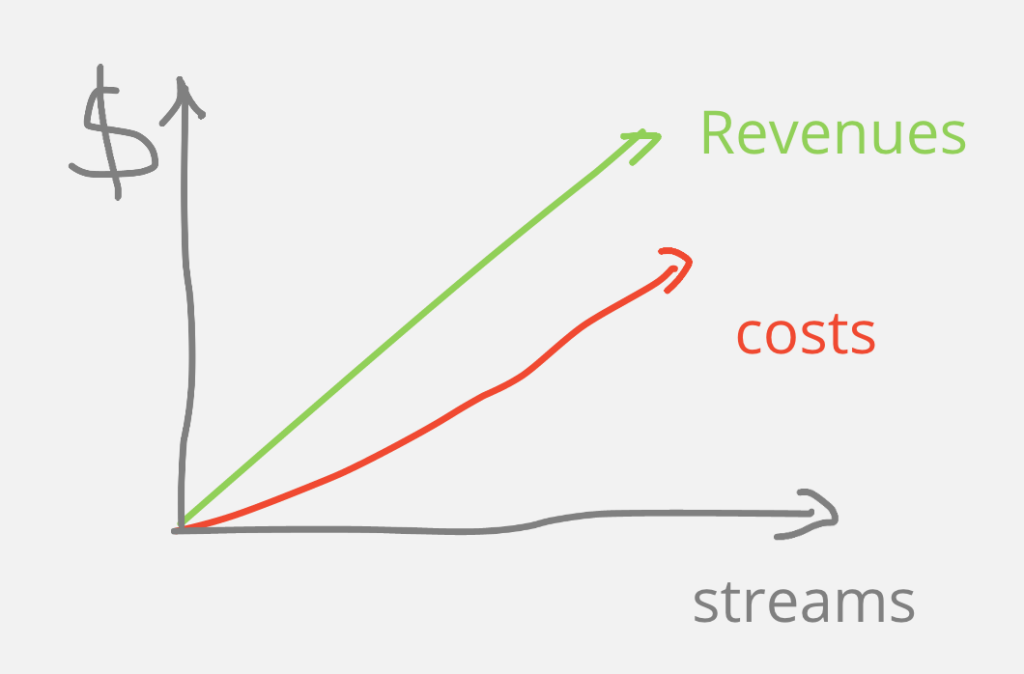

Whilst the music industry has helped Spotify achieve multi-billion dollar revenues every quarter, the industry’s power represents a fundamental shackle on Spotify’s valuation.

Music labels (Spotify suppliers) have negotiated royalties based on usage. This means, as usage and revenue increase, costs increase as well. The record labels take the same 70% cut whether it’s on revenue of $100 million or $10 billion. As long as the majority of revenue generated by Spotify is related to listening to music, it can never enjoy the increasing returns to scale of higher usage.

Whilst paid premium subscriptions represent the bulk of Spotify revenue (currently north of 85%), the podcasting market represents a far larger opportunity.

Podcast Market- a tiny (but growing market)

The reason why I emphasised the word ~ opportunity ~ is because podcast revenue right now is not able to sustain Spotify. This is supported by the fact that Spotify does not report separate revenues attributable to podcast advertising. It is not materially large enough to make a difference.

The total advertising revenue was roughly around $500 million US in 2019. In contrast, Spotify made $1.8 Billion in music streaming revenues in 1Q2020. The entire yearly podcasting market could not cover 1 month of revenue generated by Spotify’s core music business.

Podcast advertising right now is a little like a set of russian nesting dolls.

Podcasting is an underrated corner of internet advertising.

Internet advertising is an underrated part of overall advertising

One of the iron laws of advertising is that attention = advertising spend $

This can give us a looking glass into the upcoming trends. Immature markets often capture attention first, then advertising dollars come later.

Mary Meeker’s annual Internet Trends reports explain why internet advertising still is underappreciated. A sign of market maturity is comparing the share of attention vs share of marketing spend. The share of human attention on the internet is much higher than the share of internet advertising dollars, meaning that advertising on the internet is still likely to grow. Podcast advertising has captured user attention (and is still growing) but advertising and monetisation models have yet to catch up.

So podcasts are an underrated segment in an underrated market – Internet Advertising. Podcast advertising is likely to benefit from 2 tailwinds – a growing share of internet advertising itself and internet advertising growing as a percentage of total advertising.

Direct Response Advertising

Podcast advertising is still largely in the form of Direct Response Advertising with firms that have high lifetime values (Domain name providers, subscription services (Dollar Shave Club, VPN’s, meal kit companies etc). Direct Response Advertising is designed to get an instant response by encouraging people to take a specific action. The most common action in podcast advertising is the personalised discount code (“use code: rogan at checkout for 10% off”).

Think about the entire funnel:

- All people who listen to podcast

- Paying enough attention to hear the ad when it is read out

- Visit that website

- Make that purchase

- Remember the discount code to apply it during checkout

This is an incredibly long and leaky funnel. Discount codes also offer a crude way of tracking campaign impact and are largely a hack around the limitations of the RSS protocol – the dominant way in which podcasts are distributed today).

Brand Advertising – the Holy Grail

Separate from Direct Response Advertising there is another form of advertising called Brand Advertising in which companies try to establish connections and build relationships with consumers over time. Think of Coca Cola associating itself with holidays, summer and family or Nike celebrating athletes.

Brand advertising represents a much larger opportunity than Direct Response advertising and is mostly done on TV, billboards, radio, newspapers and magazines.

Currently, advertisers don’t view podcasts as a viable channel for brand advertising. This is largely due to the lack of listener data and the relative immaturity of the market. Brands have decades long experiences advertising on TV, radio and magazines. Podcasting is still a new area for them.

Spotify’s Play

Spotify aims to change this by singlehandedly kickstarting the podcast advertising market.

The first problem that Spotify is solving is the technology that underpins podcast distribution – RSS, which only offers one metric – total reach. RSS was a technology first developed in 1990’s to help distribute website content to news aggregators. The latest update to RSS was in 2009! 12 years ago!

RSS feeds don’t offer detailed analytics beyond how many people have downloaded an episode. (Yes that’s right. Podcast creators cannot even tell how many people listened to their episodes let alone detailed analytics like engagement throughout the episode). Importantly, RSS offers no data back to the podcast producers about their listeners – their age, device, listener behaviours. These are all metrics that have become important in powering the advertising marketplaces of Google and Facebook.

To fix this, Spotify has launched Streaming Ad Insertion technology which allows dynamic ads to be inserted according to a listener’s profile. The end vision for Spotify could be to create a Google Adwords model where a mini-auction is conducted where advertisers for that particular listener, before each ad is served.

If Spotify is able to successfully kickstart the podcast advertising market it has the opportunity to start an incredibly powerful flywheel:

- Attract more advertisers to the Spotify advertising platform

- Convince more podcast creators to choose Spotify’s advertising platform to monetise their content

- More podcasting content attracts more listeners

- More listeners feeds back into bringing even more advertisers into the ecosystem

The important part to remember about a flywheel strategy is to not focus on any particular input into the flywheel – all of the effects reinforce each other. More importantly Spotify can leverage existing relationships with advertisers on the free tier of Spotify’s music streaming.

A No Lose Situation

“For music listeners who do engage in podcasts, we are seeing increased engagement and increased conversion from Ad-Supported to Premium. Some of the increases are extraordinary, almost too good to be true.”

Q3 2019 Spotify Press Release

That is an incredible statement and speaks to the completely asymmetric style of bet that podcasts represent for Spotify.

The worst case situation is that Spotify does not gain traction in the podcasting market either through gaining listeners or building the right advertising market. Even in this scenario, podcasts help improve Spotify’s current core business – Premium members paying for music. Admittedly, in this scenario Spotify does not become an advertising juggernaut on the level of Facebook, Google etc.

A better case scenario is that they figure out advertising for podcasting. In this case Spotify has 3 revenue streams – (podcast advertising + free music advertising + paid music subscriptions)

In the best scenario, Spotify manages to figure out podcasting advertising and is demonstrably better for Brand Advertisers driving huge amount of ad revenue through them (in this case they become Facebook, Google, possibly even bigger).